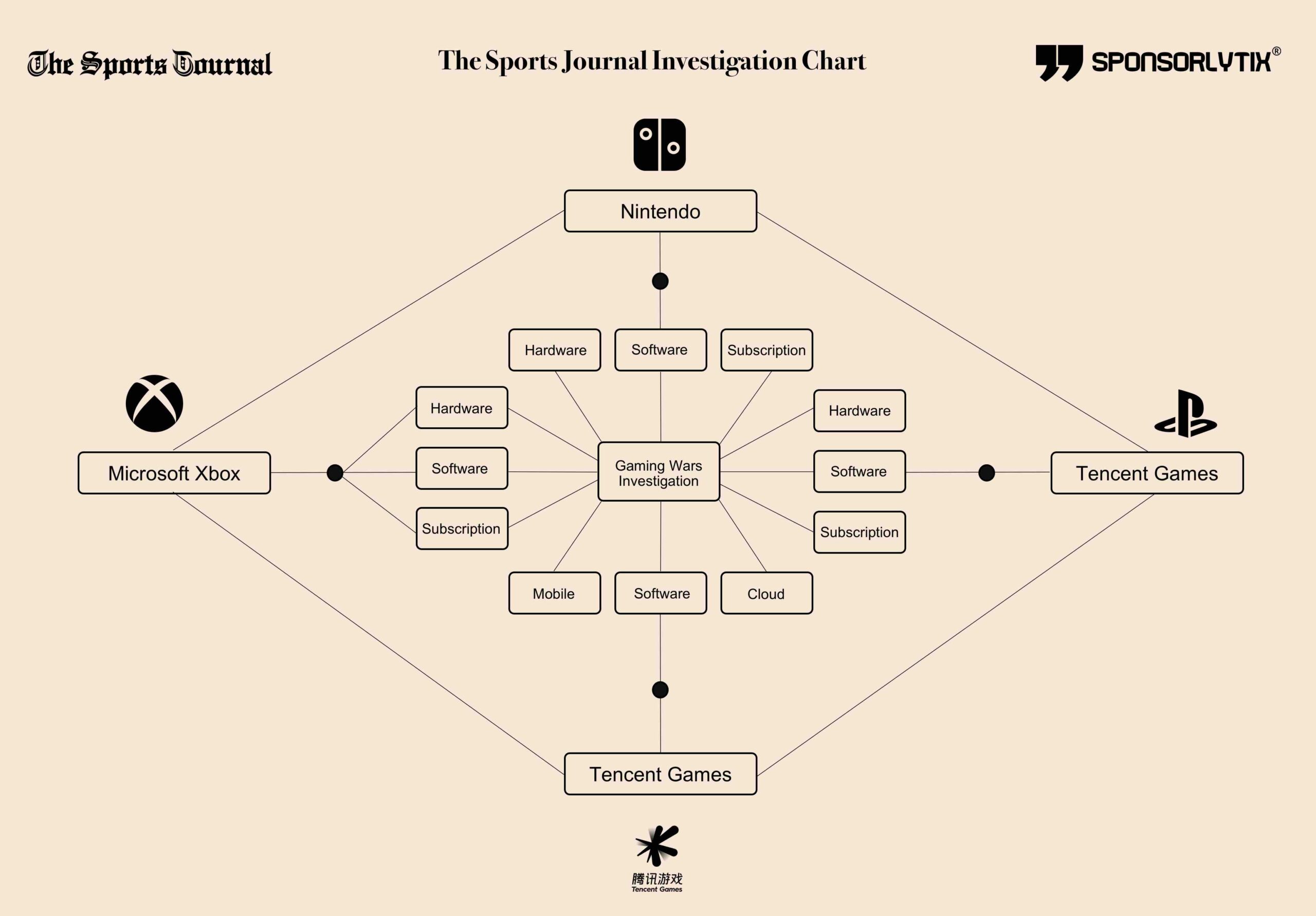

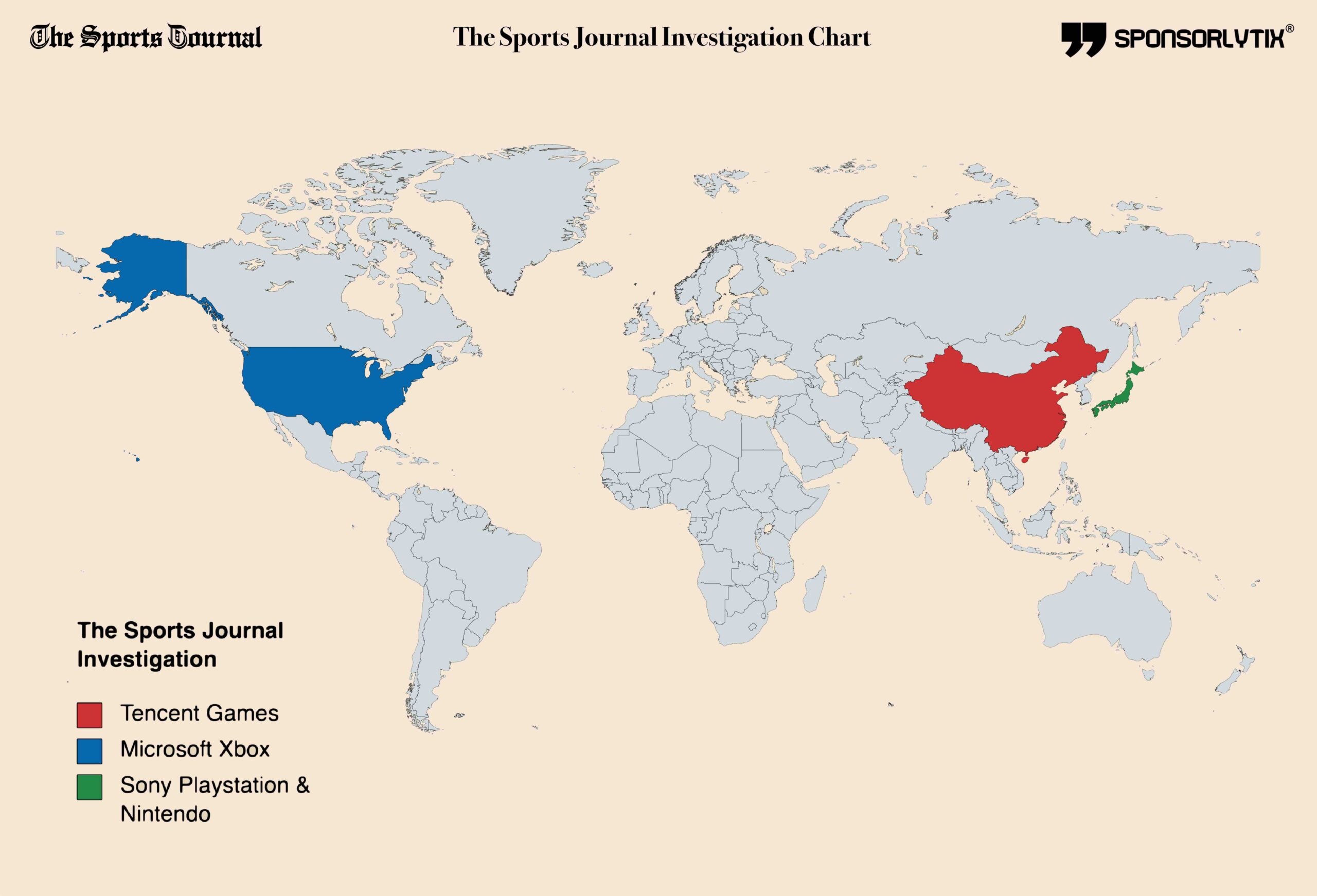

The gaming industry generates over $250 billion each year, and according to the Sports AI company Sponsorlytix, it is projected to reach $650 billion by 2034. An industry poised to surpass the trillion-dollar mark within the next two decades sees the four gaming behemoths fiercely vying for supremacy and market dominance. This intense competition unfolds among the industry’s key players: Sony Playstation, Microsoft Xbox, Nintendo, and Tencent Games. The Sports Journal conducted an in-depth investigation in collaboration with Sponsorlytix to delve into the intricate dynamics of this multifaceted competition.

Tencent Games holds the title of the world’s largest gaming company, boasting impressive revenues of $26.5 billion in 2023. With a commanding 33.2% of the market share, Tencent Games surpasses competitors like Playstation, Xbox, and Nintendo. Notably, the company either owns or has invested in minority/majority equity shares in some of the largest gaming studios and developers, solidifying its dominant position in the industry.

Our comprehensive investigation goes beyond mere sales figures, exposing the strategic intricacies of the gaming wars, from total console sales to exclusive game IPs and strategic acquisitions, reshaping the industry’s landscape. Unraveling not only the statistics but also delving into the strategic manoeuvres and industry-altering decisions that have shaped this gaming war.

The gaming industry has undergone a metamorphosis over the years, with each of the four giants leaving an long lasting mark on gaming culture. From the early days of pixelated adventures to the immersive, cinematic experiences of today, this journey sets the stage for the intense competition we witness today.

Total Console (Hardware) Sales – Tencent vs Playstation vs Nintendo vs Xbox

The pulsating heart of the gaming industry lies in hardware sales, defining the extent of a company’s presence within the living rooms and bedrooms of gamers worldwide.

Source: Sponsorlytix

Nintendo stands tall, an undisputed champion with an astounding 876.54 million units sold so far since its inception.  Playstation follows, with a considerable gap with 511.81 million units so far, while Xbox maintains a formidable position with 193.71 million units. Tencent, known for its mobile and cloud focus, does not sell hardware products to their vast global customers, emphasizing its unique approach to gaming dominance.

Playstation follows, with a considerable gap with 511.81 million units so far, while Xbox maintains a formidable position with 193.71 million units. Tencent, known for its mobile and cloud focus, does not sell hardware products to their vast global customers, emphasizing its unique approach to gaming dominance.

Hardware sales isn’t just about numbers; it’s about the evolution of gaming consoles as cultural phenomena. Nintendo’s dominance isn’t just in units sold; it’s a testament to the enduring popularity of franchises like Mario and Zelda. Playstation’s success represents the marriage of cutting-edge technology and compelling exclusive content, while Xbox has carved its niche with a robust online gaming ecosystem.

Source: Sponsorlytix

Nintendo’s success in hardware isn’t just about sheer volume; it’s about innovation. From the revolutionary NES to the innovative Wii to the hybrid brilliance of the Switch, Nintendo’s hardware strategy mirrors its commitment to redefining how we play. The unprecedented success of the Switch and its unique selling points – from portability to the joy-con controllers – cements Nintendo’s status as a pioneer in the gaming hardware space.

Source: Sponsorlytix

Playstation’s captivating hardware journey mirrors the remarkable technological strides within the gaming industry. The evolution from the groundbreaking PlayStation 1 to the current powerhouse, the PS5, exemplifies Sony’s unwavering dedication to pushing the boundaries of gaming technology.

Playstation’s captivating hardware journey mirrors the remarkable technological strides within the gaming industry. The evolution from the groundbreaking PlayStation 1 to the current powerhouse, the PS5, exemplifies Sony’s unwavering dedication to pushing the boundaries of gaming technology.

The PS5’s cutting-edge features, including its lightning-fast SSD, advanced ray tracing capabilities, and the immersive DualSense controller, stand as testament to Sony’s commitment to redefining the gaming experience. In doing so, Playstation not only remains a market leader but also solidifies its reputation as a trailblazer and an influential force in driving innovation within the gaming landscape.

Source: Sponsorlytix

Xbox’s hardware story intertwines with the rise of online gaming. From the original Xbox’s foray into broadband-connected  gaming to the Xbox Series X’s prowess in 4K gaming and ray tracing, Microsoft’s commitment to an interconnected gaming

gaming to the Xbox Series X’s prowess in 4K gaming and ray tracing, Microsoft’s commitment to an interconnected gaming

community is palpable. The acquisition of ZeniMax Media and Activision Blizzard, which generate on average about $8 billion in revenues each year, signals a strategic shift, reinforcing Xbox’s dedication to exclusive content.

In a unique twist, Tencent stands apart by forgoing traditional hardware. Instead, the Chinese gaming giant focuses on mobile gaming and cloud services, tapping into a global market with a different approach. Tencent’s success lies not in units sold but in its ability to seamlessly integrate gaming into everyday life through WeChat, QQ.com and mobile gaming, creating a digital ecosystem that extends far beyond traditional consoles.

Total Software Sales – Tencent vs Playstation vs Nintendo vs Xbox

The software stream is a dynamic arena showcasing exclusive titles and third-party collaborations, stands as the backbone of any gaming ecosystem.

Nintendo commands the lead in total software sales, boasting an impressive 5.69 billion units. Playstation follows closely with 5.51 billion units, while Xbox secures the third position with 2.24 billion units. Notably, Tencent’s primary focus on mobile and cloud services results in zero recorded hardware and software unit sales.

Nintendo commands the lead in total software sales, boasting an impressive 5.69 billion units. Playstation follows closely with 5.51 billion units, while Xbox secures the third position with 2.24 billion units. Notably, Tencent’s primary focus on mobile and cloud services results in zero recorded hardware and software unit sales.

Software sales are more than mere transactions; they are narratives woven into the fabric of gaming culture. Each unit sold represents not just a game but an experience, a world explored, and a story told.

Nintendo’s software success isn’t just about the quantity of units sold; it’s a reflection of the timeless appeal of its exclusive franchises, which are almost fully exclusive to Nintendo consoles or rarely available on other platforms like PC or mobile gaming. From the whimsical charm of Mario Kart to the adventurous brilliance of Legend of Zelda, Nintendo’s software lineup transcends gaming; it’s a cultural phenomenon that resonates with players of all ages.

Source: Sponsorlytix

Playstation’s software dominance is grounded in storytelling. Exclusive titles like Ghost of Tsushima and The Last of Us aren’t just games; they are cinematic experiences that push the boundaries of narrative in gaming. Sony’s commitment to  fostering diverse narratives, from action-packed adventures to emotional journeys, solidifies its position as a storytelling powerhouse.

fostering diverse narratives, from action-packed adventures to emotional journeys, solidifies its position as a storytelling powerhouse.

Xbox’s software strategy takes a revolutionary turn with Game Pass. It’s not just about selling individual units; it’s about access. Game Pass transforms gaming into a subscription-based service, offering a vast library of games for a monthly fee. This shift from ownership to access reshapes how players consume and experience games, marking a paradigm shift in the industry. Xbox’s exclusive software lineup, featuring iconic titles such as Halo, Starfield, Sea Of Thieves, and Gears Of War, further enhances the allure of Game Pass, providing subscribers with an exclusive and diverse gaming experience.

Tencent’s software story unfolds in the mobile gaming arena. With titles like Honor of Kings and PUBG Mobile, Tencent has mastered the art of capturing audiences on the go. Free-to-play models, in-app purchases, and mobile advertising form the pillars of Tencent’s software revenue model, proving that gaming isn’t confined to consoles or PCs.

Gaming Developers & Studios Acquired or Invested by Each Company

Acquiring massive gaming developers and studios has become a pivotal strategy for the four gaming giants to outdo each other and enhance their market share. These acquisitions transcend mere business transactions; they signify the amalgamation of creative forces, a union of talent and resources. This strategic approach not only elevates revenues but also solidifies the companies’ positions in the competitive gaming landscape.

Tencent’s acquisition spree spans the globe, from Riot Games in 2011 to the recent addition of Roblox. The Chinese giant’s “silent” investments in diverse studios, including Epic Games and Supercell, showcase a nuanced approach to global expansion. Tencent isn’t just acquiring; it’s strategically positioning itself as a global force in gaming, orchestrating a symphony of diverse talents.

Xbox’s acquisition strategy, under the leadership of CEO Phil Spencer, mirrors the company’s ambition to create a formidable gaming portfolio. The $7.5 billion acquisition of ZeniMax Media (Bethesda Softworks), home to iconic franchises like Elder Scrolls, Fallout and Starfield, amplifies Xbox’s commitment to exclusive content. With the close of the $69 billion purchase of video game publisher Activision Blizzard (developer of the iconic Call Of Duty games). This further solidifies Xbox’s status as a gaming powerhouse, with a diverse array of studios under its umbrella.

Gaming Developers & Studios Acquired or Invested

| ND Cube | Bend Studio | 343 Industries | Funcom |

| Mario Club | Bluepoint Games | Alpha Dog Games | Leyou |

| 1-Up Studio Inc | Bungie | Arkane Studios | Riot Games |

| Monolith Software Inc | Firesprite | Beenox | Sharkmob |

| iQue | Fabrik Games | Bethesda Game Studios | Turtle Rock |

| Next Level Games | Firewalk Studios | Bethesda Softworks | Wake Up Interactive |

| Retro Studios | Guerrilla Games | Blizzard Entertainment | Supercell |

| SRD | Haven Studios | Compulsion Games | Grinding Gear Games |

| The Pokemon Company | Housemarque | Demonware | Epic Games |

| Warpstar Inc. | Insomniac Games | Digital Legends | Pocket Gems |

| Nintendo Systems Co | London Studio | Double Fine Productions | Sea Limited (Garena) |

| AlphaDream | Media Molecule | High Moon Studios | Dontnod Entertainment |

| Jupiter | Naughty Dog | id Software | Bloober Team |

| Camelot Software Planning | Nixxes Software | Infinity Ward | Marvelous |

| Nintendo SPD and Nintendo SDD | Polyphony Digital | Inxile Entertainment | Netmarble |

| Intelligent Systems | San Diego Studio | King | Kakao |

| Rare | San Mateo Studio | MachineGames | Bluehold Studio |

| Sony XDev | Mojang Studios | Frontier Developments | |

| Savage Game Studios | Ninja Theory | Sumo Group | |

| Sucker Punch Productions | Obsidian Entertainment | Kadokawa Corporation | |

| Team Asobi | Playground Games | Paradox Interactive | |

| Valkyrie Entertainment | Radical Entertainment | Ubisoft | |

| Rare | Remedy Entertainment | ||

| Raven Software | 1C Entertainment | ||

| Roundhouse Studios | 10 Chambers Collective | ||

| Sledgehammer Games | Fatshark | ||

| Tango Gameworks | Klei Entertainment | ||

| The Coalition | Miniclip | ||

| The Initiative | Yager Development | ||

| Toys for Bob | Bohemia Interactive | ||

| Treyarch | Offworld Industries | ||

| Turn 10 Studios | Payload Studios | ||

| Undead Labs | Playtonic Games | ||

| World’s Edge | Voodoo | ||

| Xbox Games Studios Publishing | Aiming | ||

| ZeniMax Online | Discord | ||

| Inflexion Games | |||

| Lockwood Publishing | |||

| PlatinumGames | |||

| Roblox |

Source: Sponsorlytix

Sony’s approach to acquisitions is a delicate dance of nurturing internal talent and strategically acquiring external studios. From the recent addition of Firewalk Studios to the longstanding partnership with Naughty Dog, Sony’s 21-studio strong lineup reflects a commitment to diversity and quality. Each acquisition adds a unique brushstroke to the canvas of Playstation’s gaming ecosystem.

Nintendo’s approach to acquisitions is marked by precision. The acquisition of Dynamo Pictures, leading to the formation of Nintendo Pictures Co., Ltd., is part of a comprehensive rebranding effort. Beyond this, Nintendo’s history of partnerships, including Rare, Retro Studios, and Intelligent Systems, exemplifies a commitment to long-term collaborations and a diverse creative ecosystem.

In the quest for gaming supremacy, the acquisition of developers and studios becomes a strategic move to secure exclusive content.

Source: Sponsorlytix

Tencent emerges as a powerhouse, leading the acquisitions race with a staggering 40 strategic moves. Microsoft’s Xbox follows closely with 36, Sony’s Playstation with 22, and Nintendo with 17, exemplifying a focused approach to talent acquisition.

Subscription Models – Game Pass vs Playstation Plus vs Nintendo Switch Online vs Tencent Cloud

Subscription models have become a linchpin in the gaming revenue structure, providing players with access to a curated gaming experience. The rise of Game Pass, Playstation Plus, Nintendo Switch Online, and Tencent Cloud showcases a shift in how gamers consume content.

Subscription models have become a linchpin in the gaming revenue structure, providing players with access to a curated gaming experience. The rise of Game Pass, Playstation Plus, Nintendo Switch Online, and Tencent Cloud showcases a shift in how gamers consume content.

Playstation Plus Premium, with its 50.3 million subscribers, stands as the crown jewel in Sony’s subscription empire. Beyond the allure of free monthly games including The Last Of Us and Uncharted, exclusive discounts, and online multiplayer access, Playstation Plus Premium has become a gateway to the immersive world of Playstation exclusives, creating a dedicated community of subscribers.

Xbox’s Game Pass isn’t just a subscription service; it’s a paradigm shift. With 32 million subscribers, Game Pass transforms gaming into a buffet, offering a vast library of games for a monthly fee. The inclusion of day-one releases and a diverse catalog, from indie gems like Hi-Fi Rush to blockbuster titles like Gears Of War and Halo, has redefined how players approach gaming, emphasizing access over ownership.

Source: Sponsorlytix

Nintendo Switch Online, with 38 million subscribers, bridges the gap between nostalgia and modern gaming. The inclusion of classic NES and SNES titles, coupled with online multiplayer access, provides a unique proposition. The success of Nintendo Switch Online lies not just in its features but in its ability to evoke a sense of shared gaming history.

classic NES and SNES titles, coupled with online multiplayer access, provides a unique proposition. The success of Nintendo Switch Online lies not just in its features but in its ability to evoke a sense of shared gaming history.

Tencent Cloud, with its 1 million subscribers, represents a unique approach to subscription models. As a cloud computing service for game developers, studios, and publishers, Tencent Cloud’s success isn’t measured in individual subscriptions but in its role as a behind-the-scenes enabler, powering the infrastructure of countless games worldwide.

Subscription models have evolved into a significant revenue stream, offering gamers access to exclusive content and services.

Playstation Plus Premium leads the subscription race with 50.3 million subscribers, followed closely by Game Pass with 32 million. Nintendo Switch Online boasts 38 million subscribers, while Tencent Cloud trails with 1 million subscribers, revealing the diverse strategies employed by these gaming giants.

Exclusive Games IP and Unit Sales

Beyond units sold, Exclusive game IP represent a company’s ability to create cultural phenomena, shaping the gaming spirit.

Nintendo’s exclusive IPs, from Pokémon to Mario Kart, aren’t just games; they’re cultural touchstones. The enduring popularity of Mario Kart 8 Deluxe, with 58.4 million units sold, exemplifies Nintendo’s mastery in creating timeless icons that resonate across generations.

Nintendo Exclusive Games IP and Unit Sales

| Unit Sales | |

| Mario Kart 8 Deluxe | 58.4m |

| Animal Crossing: New Horizons | 46.28m |

| Super Smash Bros. Ultimate | 34.8m |

| The Legend of Zelda: Breath of the Wild | 33.18m |

| Super Mario Odyssey | 27.35m |

| Pokémon Scarlet + Pokémon Violet | 23.29m |

| New Super Mario Bros. U Deluxe | 17.3m |

| SLuigi’s Mansion 3 | 13.46m |

| Mario Party Superstars | 12.67m |

| Pokémon Quest | 11.2m |

| Splatoon 3 | 10.88m |

| Mario and Rabbids Kingdom Battle | 10.4m |

| Super Mario Maker 2 | 8.7m |

| Kirby and the Forgotten Land | 7.43m |

| Super Mario 3D World + Bowser’s Fury | 6.65m |

| Monster Hunter Rise + Sunbreak Se | 6.2m |

| New Pokémon Snap | 3.8m |

| Mario Golf: Super Rush | 3.62m |

| Xenoblade Chronicles 3 | 1.98m |

| Pretty Princess Magical Garden Island | 1.8m |

| Triangle Strategy | 1.3m |

Source: Sponsorlytix

Playstation’s exclusive IPs read like a list of cinematic blockbusters. From the pulse-pounding suspense of Five Nights at Freddy’s to the cinematic experience of The Last Of Us, which was recently converted to the hit series on HBO played by Pedro Pascal, to the immersive racing experience of Gran Turismo 7, each title is a testament to Sony’s commitment to cinematic storytelling in gaming.

Playstation Exclusive Games IP and Unit Sales

| Unit Sales | |

| Gran Turismo Series | 90m |

| God of War Series | 68m |

| The Last of Us Series | 38.7m |

| Marvel’s Spider-Man Series | 35m |

| Five Nights at Freddy’s: Security Breach | 32m |

| Horizon Zero Dawn | 24.9m |

| Death Stranding | 16.15m |

| UNCHARTED: Legacy of Thieves Collection | 13.1m |

| Ratchet & Clank Series | 12.5m |

| Ghost of Tsushima | 10.3m |

| Detroit: Become Human | 9.1m |

| Horizon Forbidden West | 8.6m |

| Days Gone | 8.5m |

| Bloodborne | 8m |

| Ghostwire: Tokyo | 4.3m |

| Until Dawn | 4.13m |

| Nioh 2 Remastered | 2.83m |

| Marvel’s Iron Man VR | 2.5m |

| Blood & Truth | 1.7m |

| The Last Guardian | 1.35m |

| Sackboy: A Big Adventure | 1.2m |

| WipEout | 1.2m |

| Astro Bot Rescue Mission | 0.8m |

| Valkyrie Elysium | 0.8m |

| Returnal | 0.64m |

| Shadow of the Colossus | 0.6m |

| Destruction AllStars | 0.6m |

| Dreams | 0.25m |

Source: Sponsorlytix

Xbox’s exclusive IPs cover a wide range of genres, presenting a diverse and impressive portfolio. From the immensely popular Sea of Thieves, boasting 35 million players, to the newly launched Starfield, which quickly amassed over 12 million players on GamePass within weeks. The Halo Infinite powerhouse, having sold 21.6 million units, stands proudly next to iconic titles like the Gears of War Series, Minecraft Dungeons, and the upcoming Outer Worlds 2, exemplifying Xbox’s dedication to serving a broad gaming audience.

Xbox Exclusive Games IP and Unit Sales

| Unit Sales | |

| Gears of War Series | 45m |

| Minecraft Dungeons | 27m |

| Halo Infinite | 21.6m |

| Forza Horizon & Motorsport Series | 16.3m |

| Starfield | 12m |

| Disney Rush: A Disney Pixar Adventure | 3.5m |

| Super Lucky’s Tale | 3.3m |

| Ori and the Will of the Wisps | 2.2m |

| The Outer Worlds 2 | 2m |

| Sunset Overdrive | 1.9m |

| Halo Wars | 1.87m |

| Crackdown 3 | 1m |

| RARE Replay | 0.82m |

| Quantum Break | 0.75m |

| Robocraft Infinity | 0.4m |

| Redfall | 0.3m |

Source: Sponsorlytix

Tencent’s exclusive IPs, empowered by its expansive global network, traverse an array of genres and platforms. Renowned titles such as League of Legends and PUBG Mobile exemplify Tencent’s profound influence on the gaming landscape, characterized by its remarkable capacity to captivate a diverse and worldwide audience. This transcendent impact extends beyond the confines of a conventional console-centric approach, solidifying Tencent’s position as a major force in the global gaming industry.

Tencent Exclusive Games IP and All Time Revenues

| Revenue (all time) | |

| PUBG: Battlegrounds | $13.8b |

| League of Legends | $13.48b |

| Honor of Kings | $10.2b |

| PUBG Mobile | $10.2b |

| CrossFire: Legends | $4.2b |

| Game for Peace | $4.1b |

| ArcheAge | $0.4b |

| Crossfire | $1.3b |

| Chess Rush | $0.06b |

| Ring of Elysium | $0.2b |

| Arena of Valor | $0.2b |

| Roco Kingdom | $1.1b |

| SYNCED: Off-Planet | $0.04b |

| Alliance of Valiant Arms | $0.03b |

| Happy Farm | $0.04b |

| Honor of Kings: World | $1.6b |

| Call of Duty: Mobile | $1.4b |

| Moonlight Blade | $1.4b |

| Call of Duty Online | $1.4b |

| QQ Pet | $1.3b |

| PUBG Mobile Elite | $1.3b |

| Love Nikki-Dress UP Queen | $0.5b |

| Metal Slug | $0.08b |

| Path of Exile | $0.02b |

| QQ Sanguo | $0.4b |

| GKART | $0.05b |

| Dengeki Bunko: Crossing Void | $0.01b |

| Monster Hunter Online | $0.2b |

| Smite | $0.34b |

| Pokémon Unite | $0.06b |

| FIFA Online 4 | $0.09b |

| Dragon Raja | $0.01b |

| Need for Speed Online | $0.08b |

| League of Legends: Wild Rift | $0.2b |

| Apex Legends Mobile | $0.05b |

| Light and Night | $0.01b |

| Undawn | $0.03b |

| DragonNest2: Evolution | $0.01b |

| Craz3 Match | $0.01b |

| Iris.Fall | $0.01b |

| Warhammer: End Times – Vermintide | $0.02b |

| Crown Trick | $0.06b |

| Infinity Blade | $0.08b |

| Xuan Dou Zhi Wang | $0.2b |

| Contra | $0.01b |

| System Shock 3 | $0.6b |

| Code: To Jin Yong | $0.2b |

| Arena Breakout: Realistic FPS | $0.03 |

| Metal Slug: Awakening | $0.02b |

Read our investigation – Illegal Sports Streaming & Piracy

Read our investigation – Overpaid Football Players Salaries

Total Revenue Comparison – Tencent vs Playstation vs Nintendo vs Xbox

Revenue is more than a financial metric; it’s a crescendo in the gaming symphony, reflecting the culmination of successful strategies, consumer trust, and industry impact.

Revenue is more than a financial metric; it’s a crescendo in the gaming symphony, reflecting the culmination of successful strategies, consumer trust, and industry impact.

Tencent’s consistent reign at the revenue summit is a testament to its multifaceted approach to gaming dominance. With revenues of $29.3 billion (2020), $27 billion (2021), $24.1 billion (2022), and $26.5 billion (2023), Tencent stands as an unparalleled giant, spanning mobile gaming, cloud services, and strategic investments. They are the biggest gaming company in the world.

Playstation’s revenue trajectory, from $24.9 billion (2020) to $24.4 billion (2021), $27 billion (2022), and $24.5 billion (2023), showcases an impactful presence just slightly behind Tencent. Sony’s commitment to quality exclusives, hardware innovation, and subscription services contributes to its enduring financial success.

Xbox, under the Microsoft umbrella, has witnessed a revenue surge. From $11.6 billion (2020) to $15.4 billion (2021), $16.3 billion (2022), and $15.5 billion (2023), Xbox’s trajectory reflects strategic acquisitions, a focus on subscription services, and a commitment to building a diverse gaming portfolio. They are expected to significantly increase their revenues in the next two years and cover the gap.

Nintendo’s revenue journey, from $12.1 billion (2020) to $16.6 billion (2021), $15.1 billion (2022), and $12 billion (2023), underscores its ability to innovate. While not reaching the revenue peaks of competitors, Nintendo’s success lies in capturing the essence of gaming as an experience rather than a transaction.

Revenue, the ultimate arbiter of financial success and market impact, provides a holistic view of a company’s standing in the gaming hierarchy. Tencent consistently emerges as the gaming giant. Playstation, Nintendo, and Xbox follow with varying revenue figures, underscoring Tencent’s formidable position.

Market Share – Tencent vs Playstation vs Nintendo vs Xbox

Market share isn’t just a numerical reflection; it’s a strategic chessboard where each move defines influence and reach. In  2022, the balance of power is strikingly nuanced.

2022, the balance of power is strikingly nuanced.

Tencent’s market share dominance in 2023, at 33.2%, solidifies its position as a global tactician. From its stronghold in the Chinese market to its strategic investments in global gaming giants, Tencent’s influence extends far beyond hardware and software sales.

Playstation’s market share of 31.3% in 2023 reflects its prowess as a narrative architect. Exclusive titles, a robust online community, and a commitment to diverse storytelling contribute to Playstation’s impact on the gaming landscape.

Xbox’s market share of 18.2% in 2023 positions it as the online vanguard. With a focus on Game Pass, online multiplayer access, and strategic acquisitions, Xbox’s influence is palpable in the evolving gaming ecosystem.

Nintendo’s market share of 17.3% in 2023 signifies its role as an innovation trailblazer. From the success of the Switch to innovative hardware concepts, Nintendo’s influence extends beyond market share, shaping the industry’s creative landscape.

Market share, a pivotal metric reflecting a company’s dominance, showcases the shifting tides in the gaming landscape.

With the strategic acquisition of Activision Blizzard, the creators of the immensely lucrative Call of Duty franchise generating an annual revenue of approximately $2.5 billion, Xbox is poised for a significant leap in the gaming industry. This move is anticipated to bolster their market share and propel them toward the ambitious goal of becoming the preeminent gaming company globally, with a clear objective of outshining their perennial rivals and industry leaders, Sony Playstation.

Simultaneously, Tencent, the silent powerhouse, is expected to solidify its dominance by making further investments as both minority and majority equity owners in prominent game developers. Their focus on expanding cloud gaming services is indicative of their persistent efforts to maintain a significant role in shaping the future of the gaming landscape.

Simultaneously, Tencent, the silent powerhouse, is expected to solidify its dominance by making further investments as both minority and majority equity owners in prominent game developers. Their focus on expanding cloud gaming services is indicative of their persistent efforts to maintain a significant role in shaping the future of the gaming landscape.

Nintendo, armed with the imminent launch of the Nintendo Switch 2, is set to further surge ahead, already holding the title of the gaming company with the highest-selling hardware consoles.

In this grand gaming narrative, the symphony of hardware, software, acquisitions, subscriptions, revenue, and market share continues to unfold. The dominance of Playstation, Xbox, Nintendo, and Tencent transcends mere statistics; it encompasses the stories told, the worlds explored, and the profound impact on gaming culture.

Source: Sponsorlytix

The ongoing battle for dominance transcends mere unit sales and revenue figures; it is about crafting compelling narratives,

innovating in ways that captivate audiences, and skill-fully navigating the complex intersections of technology, creativity, and commerce.

commerce.

Gamers eagerly await the next chapter in this captivating story, and one thing remains certain – the symphony of the gaming wars will persist in captivating, inspiring, and redefining the very essence of interactive entertainment.

The gaming wars among Playstation, Xbox, Nintendo, and Tencent have evolved into a multifaceted tapestry, weaving together elements of hardware dominance, software prowess, strategic acquisitions, and exclusive content. As Tencent’s silent yet impactful expansion continues, the gaming industry stands at the crossroads of innovation and competition, with enthusiasts eagerly anticipating the unfolding of the next thrilling chapter in this dynamic saga. The battle rages on, and the future of gaming remains an enigmatic yet exhilarating journey into uncharted territories.