Sports broadcasting through various media devices are playing a huge role in gaining popularity among the sports enthusiasts and fans. Especially, the constant developing and innovation of the smartphone has helped in this movement (if you want to call it) of sports broadcasting that has previously been limited to traditional cable and network TV.

Nothing better exemplifies the shifting sands in the world of sports media than Twitter’s deal to live-stream NFL matches. The struggling social network recently fought off competition from Facebook, Amazon, Yahoo and Verizon to win rights to show 10 Thursday night NFL games live online for free.

Should Twitter’s NFL coup prove a success and it is projecting up to $50million in advertising revenue from the $10million deal, 2018 could well see other social media giants like Facebook and Snapchat look for similar sports rights deals to secure this new medium, which is predicted to be the future of sports broadcasting.

Back in June this year, Twitter and Saudi based Sela Sport partnered to live stream the 2017 Arab Championship matches to a global audience. The move marked the first live streaming deal for a football championship based in MENA with Twitter.

Reuters

More recently in early August, Amazon outbid Sky to secure the UK rights for all elite ATP men’s tennis tournaments except the four grand slams, for £10million a year, up from the £8million a year paid by Sky in its current five year deal which ends in 2018.

With OTT (over-the-top) now becoming more easily available, consumers are less likely to splash out large TV subscriptions for channels they don’t regularly watch – and expect that trend to increase in 2018.

In case you are not up to date, then OTT stands for “over-the-top” the term used for the delivery of film, sports, entertainment and TV content via the internet without requiring users to subscribe to a traditional cable or satellite pay TV service. OTT sits at the center of the inevitable and unstoppable merger between the worlds of television and digital video.

In the ever changing and evolving tech age, OTT gives the option of the “watch at anytime, anywhere”, which is its unique selling point. No wonder Netflix and Amazon Prime have become so popular around the world.

In addition to saving people’s time and giving a real liberty to choose their device, watching sports content on OTT platforms is relatively cheaper than subscription to PayTV. Today, subscribers will have to pay a monthly fee of around $13 a month to get “unlimited access to watch the widest array of live and on-demand sport on virtually any connected device” on one of the upcoming players of OTT platforms – Perform’s DAZN.

In the UAE and Middle East, the new OTT platform called TV.AE was launched earlier this year (which did not take off, as the MENA region is still not ready to consume sports broadcasting on OTT) offering entertainment and sports packages, live streaming the Arabian Gulf League games. OSN launched Wavo, live streaming sports from their OSN sports channels.

The Sports Journal’s parent company (DANTANI, Inc. Sports) is launching it’s own sports OTT platform called Dantani Sports Network (DSN Sports), which will offer niche sports content on VOD and later other added options like PPV and more will be offered.

Dantani Sports Network launching soon – www.dsnsports.tv

While OTT has not yet fundamentally transformed the sports broadcast business, this transformation will certainly occur when current TV contracts for major sports leagues and organizations expire over the next five to ten years.

From leagues and federations to individual clubs, the majority of sports organisations now recognise that operating a dedicated OTT service harbors a multitude of benefits, enabling them to carve out greater value from their rights, create new commercial inventory, capture more first-hand consumer data, and better serve their respective audiences through revolutionary technologies.

It is that industry-wide acknowledgement that has engendered a proliferation in branded OTT offerings across pretty well every level of the sporting ecosystem. For instance, Premier League giants Manchester United FC underlined their global appeal and an already sophisticated media mindset by rolling out their MUTV app as an OTT subscription service in 165 countries around the world.

FloSports

FloSports, is perhaps the leader when it comes to live streaming and VOD of niche sports in this rapidly shifting sports-media landscape. FloSports runs 25 Web video channels including FloTrack, FloWrestling, FloCheer, Flo¬Grappling (for Brazilian Jiu-Jitsu), FloMarching and FloDance.

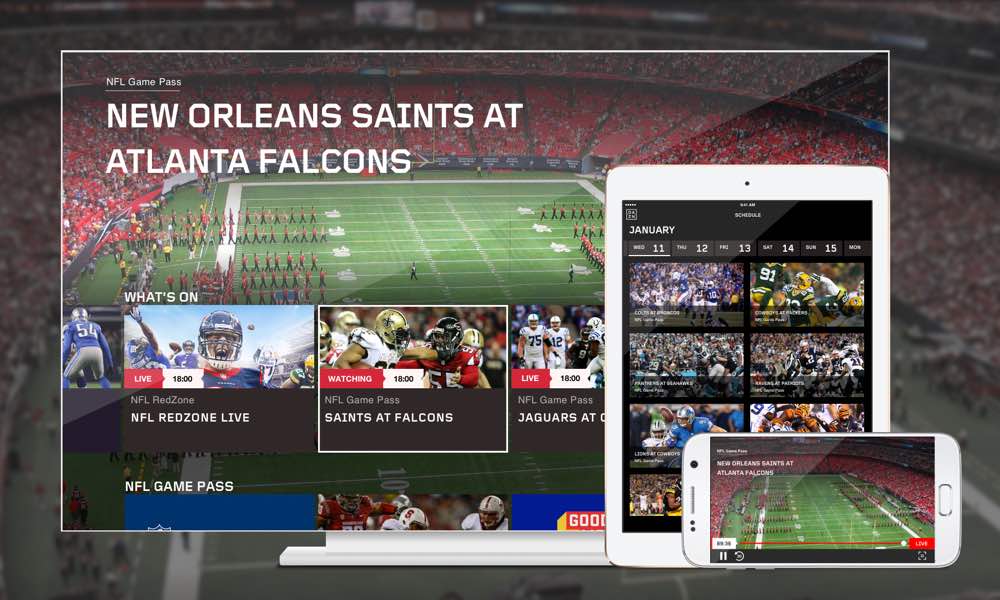

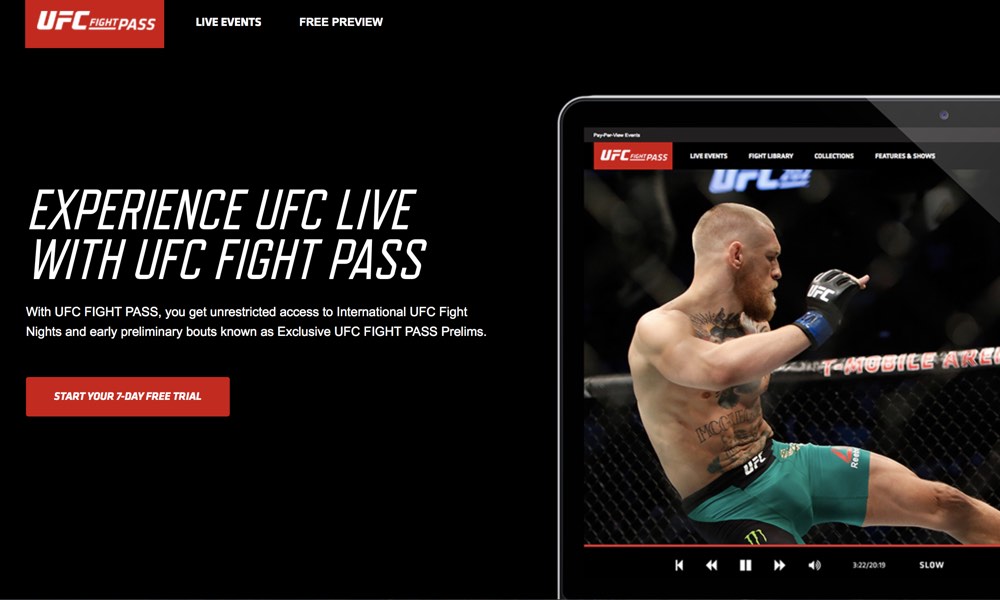

Veqta in India, Sina Sports in China, UFC Fight Pass, DAZN and MP&Silva’s Eleven Sports, have entered select markets around the world, taking a deliberately localised approach to rights acquisitions, production and distribution as they join the race to become the ‘Netflix of sports’. Another player taking a similar approach is Sportsfix, a subsidiary of the Total Sports Asia (TSA) agency now delivers live streams of lower-tier sports to mobile users across south-east Asia.

UFC FightPass

Hulu, Sony PlayStation Vue, Dish Network’s Sling TV, AT&T’s DirecTV Now and Fubo.tv have collectively shaken up the sports media landscape in the USA by offering so-called ‘skinny bundles’ that enable consumers to purchase programming on an a la carte basis, thereby stripping out any unwanted channels.

One of the major players in sports industry, occupying a unique position at the intersection of the sports, media and betting industries; Sportradar has launched its Sportradar OTT product that provides sports federations and rights holders with a customizable OTT platform.

Sportradar takes care of the technical provision, maintenance of the platform and monetizing traffic through a pay and/or an advertising-based model while the audiovisual rights holder provides and manages the content. All revenues that are generated are shared.

Currently, Sportradar has Laola1.tv as a major OTT platform, additionally it has European Handball Federation, European Hockey Federation, ITF, Lega Pallavolo Femminile, World Rallye Championship, Telekom Sport for T-Mobile and Eintracht Braunschweig.

And competition is getting tougher in sports industry day by day. Media giant Turner announced its plans to launch a standalone premium sports domestic streaming video service set to debut in 2018, as the media conglomerate will have a home for its collection of UEFA matches after also announcing a three year rights agreement with the governing body of European football starting in the 2018-19 season.

Veqta

The announcement of Turner’s OTT sports platform comes the week after Disney chairman and CEO Bob Iger said that the first ESPN-branded direct-to-consumer service will be available in early 2018 and that the first year will include about 10,000 live sports including MLB, the NHL, MLS, Grand Slam Tennis and college sports.

Development of OTT in sport may dramatically change the sport TV industry with new viewing consumption habits, new players and new business models.

According to Recode, more households in USA could be subscribed to Amazon Prime than cable TV by 2019.

According to PwC’s global entertainment and media outlook 2017–2021, global Internet advertising surpassed global TV advertising in 2015, with mobile online advertising set to overtake wired online advertising in late 2018.

Indeed, as a result of lower than expected ratings at Rio 2016, NBC Universal has decided to adapt the way it computes audience guarantees for advertisers to also account for viewing that is taking place beyond the TV. It has already implemented this for the 2018 Winter Olympics in Pyeongchang, in order to ensure it isn’t caught off guard again. As the consumption habits evolve, so must the metrics.

DAZN

There are some really interesting facts about OTT platforms according to RealnReal and Juniper Reseach:

– Nearly 90 million people are using the OTT services in USA.

– The smart phone users are using the OTT services, which increased from 60 to 80 percent by 2017.

– China has more than 460 million OTT users.

– China, US, Brazil, India and Germany are in the top five positions in the OTT service usage.

– The Video on demand services is expected to make more than half revenue from the services like Netflix.

– There is a continuous growth in the statistics of OTT market every year raising the consumption about 50% according to stats.

– The advertising revenue from the OTT services was noticed as $7billion.

– The subscription revenues for OTT may be increased to more than 60 percent in the coming year.

– 333.2 Million Global OTT subscribers is expected by 2019.

– $18Billion OTT revenue is expected by 2019.

OTT can target new audience demographics such as millennials, bringing sport to their fingertips, and extensive hours of sport content for the most hardcore of sports fans. A range of complementary digital content and solutions can be produced and delivered to rights holders, to nurture their OTT platforms and their second screen applications.

This broadened reach is an obvious benefit for sports clubs, federations and leagues when it comes to awareness, fan engagement and sponsorship opportunities. Monetization opportunities can be generated from several revenue streams:

– Increased value of rights fees with more content and new distribution segments (mobile, internet)

– Sponsorship opportunities with innovative advertising supports, increased digital audience and new targets

– B2C revenues with the launch of an OTT platform, such as NHL Game Center or NBA League Pass

OTT is the future of sports broadcasting, whether they will be able to gradually grow this ecosystem and sustain it for the long term is remained to be seen, but today, live streaming and VOD is what the consumers want and need.