Manchester City have more financial muscle than any other club in world football – according to the Soccerex Football Finance 100.

This ground-breaking new annual report by Soccerex, which has produced many ‘eye-catching’ results, uses a bespoke methodology to evaluate and rank the top 100 clubs across the planet based on their finances.

Manchester City topped the global rankings with a Football Finance Index (FFI) score of 4.883, which factors in five variables – playing assets, fixed assets, money in the bank, potential owner investment and net debt.

Paris Saint-Germain, who smashed the world transfer record to sign Brazilian superstar Neymar in August, are only third (4.128) – having unexpectedly been pipped to second place by Arsenal (4.559).

UK clubs dominate the top ten, with fifth-placed Tottenham Hotspur (2.591) surprisingly ahead of both Manchester United in seventh (2.314) and Chelsea in ninth (2.073).

SoccerEx

Reflecting China’s growing significance in the global market and their huge investment into football, Guangzhou Evergrande (3.423) are fourth while La Liga giants Real Madrid are sixth (2.579).

Barcelona (13th, 1.626) don’t even make the top ten, which is completed by 33-time Serie A winners Juventus (eighth, 2.260) and Bundesliga powerhouse Bayern Munich (2.086). Liverpool are 16th (1.370).

The Soccerex Football Finance 100 study underlines how the global football landscape has changed dramatically over the past two decades, largely due to increased investor interest from billionaires across Europe, Asia Pacific, the Middle East and the Americas and escalating broadcast revenue.

Manchester City topping the Soccerex Football Finance 100 will come as little surprise, being one of the most prominent cases of significant foreign investment transforming a club’s status and potential.

Abu Dhabi-based multibillionaire owner Sheikh Mansour bin Zayed Al Nahyan has injected over €650million into the playing squad and infrastructure and the club’s financial power has been further boosted by huge Premier League broadcast deals.

Arsenal as high as second?

ESPN

Arsenal’s lofty position – especially being ahead of PSG – will raise eyebrows due to the criticism the club faces from some quarters for a perceived lack of spending in the transfer market.

The Soccerex Football Finance 100 explains the North London club’s ranking is a reflection of their sound business model, which sees them near the top in four of the five key variables while also having relatively low net debt.

The study adds: “This position of financial strength means Arsenal could invest significantly should the hierarchy at the club choose to change their business strategy.”

World club owners’ net worth revealed as China & US powerbase grows

KNIX

The Soccerex Football Finance 100 study finds the owners of the top 100 ranked clubs have a combined net worth of just over €475bn.

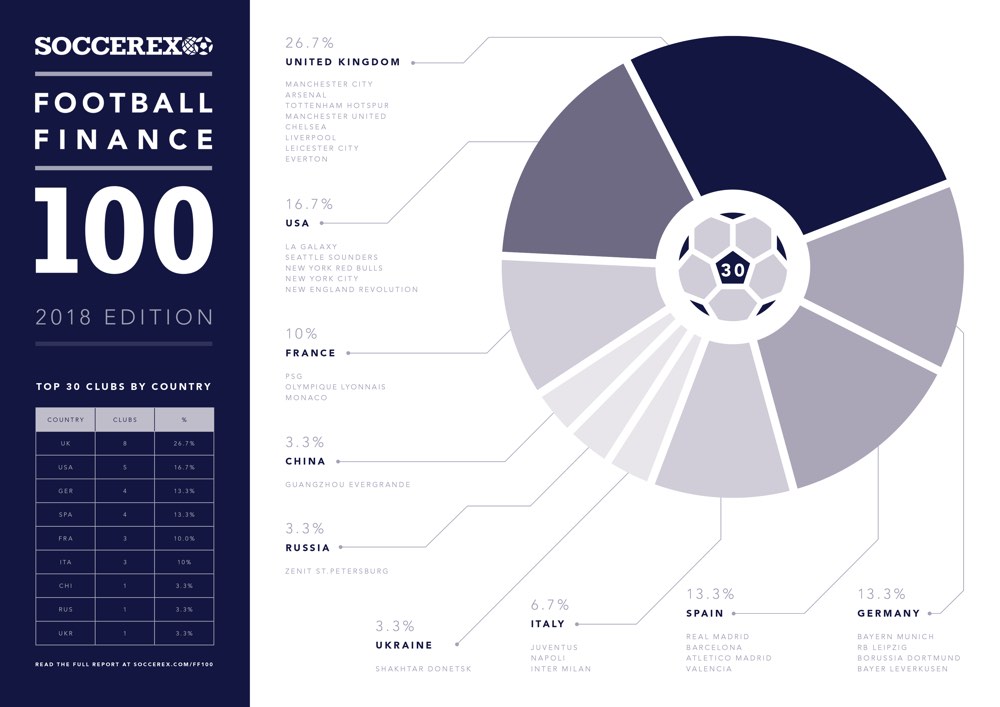

The owners of the nine largest clubs in China have a net worth of €75.1bn and the financial potential of the Chinese Super League is underlined by nine of its clubs populating the top 100 – level with Spain and more than France, Germany and Italy.

The US is the second most-represented country in the top 30 with five teams, spearheaded by LA Galaxy in 14th. This is largely due to solid business models, high-value assets and strong investment.

It is a different story in South America. Despite its rich football heritage, the region is a notable absentee in the top 30 as national economic instability is reflected in its financial position. Brazil, however, has 12 clubs ranked between 50 &100.

Abramovich’s Chelsea as low as ninth?

Chelsea FC

The UK dominates the upper echelons of the rankings, with eight teams in the top 30 – three more than any other nation – but Chelsea being positioned as low as ninth may surprise some given Roman Abramovich’s heavy investment.

The Stamford Bridge club’s ranking is affected by their listing of the owner’s investment as a loan, albeit one without interest or timescale, which gives them the largest net debt in the top 100.

An adjustment has been made for this in Chelsea’s ranking but if the bulk of their ‘debt’ to Abramovich was recorded as sponsorship or something similar, as it is with other clubs, the Blues would rank higher.

Is Spain beginning to wane?

The Spanish giants usually dominate football finance reports so why are Real Madrid and Barcelona ‘languishing’ in sixth and 13th respectively?

Their rankings are impacted by member ownership structures and the lack of potential owner investment. However, the study points out that should Real Madrid be capitalised via the stock markets, their overall financial power would make them worth more than any tycoon’s club.

The report also shows the increasing impact of foreign ownership on La Liga, with Atletico Madrid in 15th following the recent investment of Wanda Group, the Chinese conglomerate, while Valencia, backed by the wealth of Singapore businessman Peter Lim, also make the top 30.

Commenting on the first Soccerex Football Finance 100, Soccerex Marketing Director David Wright said: “We’re delighted to reveal the results of our first Soccerex Football Finance 100 study which highlight how the global football landscape has shifted over the past two decades.

“We wanted to create a study that provided a broader evaluation of football finances, one that reflected the modern reality of football, impacted by increased owner investment and the need for better financial management.

“By looking at factors like asset value, debt levels and crucially the amount the owner or ownership group could invest in the context of their direct environment, the report evaluates both the financial standing of each club and the economic potential they have in the market. The results have certainly been eye-catching!”

The Soccerex Football Finance 100 study has been conducted by specialists in sports financial valuations, analysing clubs’ balance sheets and annual reports from 2015/16, the last complete financial year available, plus other renowned sources of information like UEFA, Financial Times, Bloomberg, Yahoo Finance, Forbes, Transfermarkt and Hoovers.